Earnings, i.e. profit, is the lifeblood of companies. It is what sooner or later drives stock prices and enables dividends. As in everything else in life, some companies perform better than others. Inspired by the discovery that TMX Money has begun publishing historical quarterly earnings results (under the Research tab for a company's stock quote e.g. Home Capital Group (TSX: HCG)) going back as far as 1994, we decided to find which Canadian companies can boast of being earnings steamrollers - those with steady, long-term growth of quarterly profits.

We uncovered thirteen companies (there may be more since there seems to be no handy stock screener that will quickly spotlight them - we had to find them by trial and error) with an amazing record of growth -

- 10% or greater annual compound increase in earnings per share (EPS)

- through 15 or more years,

- in a quite predictable pattern, and

- no more than one quarter showing a net loss in that time.

The Canadian Earnings Steamrollers

Surprising perhaps to some, it is a diverse group, with a mix of well-known and not-so-famous names, across a number of industry sectors. Our comparison table below shows the not-lucky-but-good thirteen.

EPS data: In blue text columns are the start year of the quarterly EPS data and the compound annual growth rate. In some cases the percentages come from directly calculating the growth from the earliest to latest EPS. In other cases, where there is evident seasonal fluctuation, an estimate from an exponential curve fitted to the data looked more appropriate.

Dividend data: For three companies we show the progression of dividends to illustrate how dividends go up with earnings. All companies but CGI Group pay dividends. Other columns contain data from various free online sources (see table footnotes) that we refer to in our discussion below.

Data warning: Readers should note that the TMX data contains many gaps and some errors, usually because adjustments for past stock splits have not been made. In those cases we have had to go back to the original authoritative online source for such data, Sedar.com, where the companies are required by regulation to file all their financial statements. Sedar filings go back to 1997.

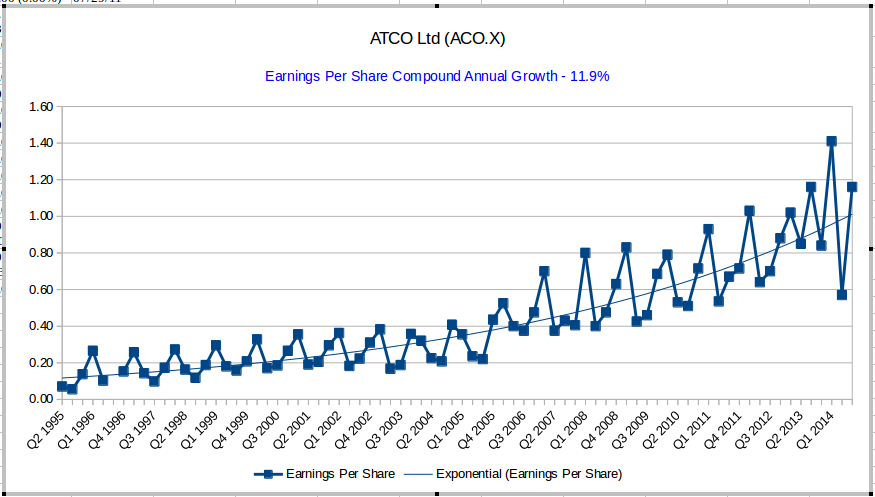

Here are the graphs for individual companies showing their quarterly EPS progression.

Home Capital Group (TSX: HCG)

The dark blue line is EPS. The orange line is dividends.

CGI Group (TSX: GIB.A)

Stantec (TSX: STN)

Saputo (TSX: SAP)

Suncor (TSX: SU)

Canadian National Railway (TSX: CNR)

Metro Inc (TSX: MRU)

Power Financial Corp (TSX: PWF)

Canadian Western Bank (TSX: CWB)

ATCO Ltd (TSX: ACO.X)

Empire Company (TSX: EMP.A)

National Bank (TSX: NA)

Royal Bank (TSX: RY)

What else can we glean from our data?

1) Strong consistent EPS growth is possible in many sectors - Our list includes some expected sectors like banks, financials and utilities , but also an industrial, an oil and gas company, a food manufacturer, an information technology company, a consulting firm and grocery retailers. Though none of these companies is tiny, several are quite small, as the range of market caps shows.

Perhaps more surprising is that Canada's largest company, the Royal Bank, has managed to grow its EPS at such a fast pace for so long. The 2008-2009 financial crisis caused considerable turbulence in its results but the steadier and rapid growth seems to have resumed.

2) The stock of most EPS steamrollers is more volatile (see Beta in our table above) than the market average (Beta of 1.0); some have quite high volatility, like HCG and Suncor. Investors and speculators in the market are obviously constantly guessing whether the amazing past growth will continue. We only have to read the media to see the kind of speculation about the future as daily events unfold with the current hot topic being the effects of the enormous drop in oil prices.

3) Total stock return in the long term, such as 15 years in our table, has reflected the EPS growth and it has far outstripped the TSX Composite average. But the shorter the term, the more variable the return, as the 1- and 5-year total return columns show. On a 1-year basis, five of our EPS powerhouses have lagged the TSX Composite. This reflects a major caveat of our results - no matter what the past, the future is not assured and market prices reflect expectations of the future. In the course of our search, we did find companies that for years were on the EPS growth trajectory and then lost their way.

4) High EPS growth doesn't only happen at high dividend payers. Some in our list pay a healthy dividend, some have a low yield, though their dividends have grown strongly over time e.g. our top dog HCG only pays a 1.8% yield but has increased its dividend 2.37% annually since 2004, when it started paying a dividend. CGI Group pays no dividend at all, reinvesting all the earnings to grow the company. Investors who have held shares since 1998 probably aren't complaining.

It is interesting that some companies with a high dividend policy like REITs do not figure in our list at all. We looked at two leading REITs, Canada's largest, RioCan (TSX: REI.UN) and H&R (TSX: HR.UN) but both have had uninspiring long term EPS growth of around 3% only. Similarly, telecomms companies like BCE (4.3% annual EPS growth since 2002) and Telus (4.6% since 1994) were not near the top achievers.

5) Poor 1-year returns and lower Price-to-Earnings (PE) figures suggest some potential buying opportunities to investigate - CGI Group, Stantec, Power Financial and Canadian Western Bank in particular. When the PE is less than the EPS growth rate and/or the 5-tear average PE, it is a positive sign. Morningstar.ca has an excellent graphical 10-year display of PE and other valuation measures benchmarked against the TSX Composite under the Valuations tab for a company stock quote (e.g. for HCG here).

There is a group of worthy runners-up with EPS growth rates of 6% to almost 10%. The following companies often showed more erratic growth; some had more quarterly net losses.

- Scotiabank (TSX: BNS) - 9.8% annual compound EPS growth since 1994

- TD Bank (TSX: TD) - 9.7% since 1994

- Canadian Tire Corp (TSX: CTC.A) - 9.7% since 1994

- Enbridge (TSX: ENB) - 9.4% since 1995

- Fortis Inc (TSX: FTS) - 9.0% since 1994

- Industrial Alliance Insurance (TSX: IAG) - 8.8% since 2000

- Canadian Utilities Ltd (TSX: CU) - 8.0% since 1996

- Great West Life (TSX: GWO) - 7.9% since 1994

- Bank of Montreal (TSX: BMO) - 6.1% since 1994

- TransCanada Corp (TSX: TRP) - 6.0% since 1999

All in all, there is a good range of companies from which to form a portfolio. Some may falter or have temporary problems but as a group, the track record suggests most will continue to steamroll onwards and upwards for investors' benefit.

Disclosure: This blogger, as well as indirectly owning all these companies through broad market ETFs, directly won shares of stock symbols SU, CNR, MRU, ACO.X, EMP.A, NA, RY, BNS, FTS, CU, BMO, TRP and BCE, as well as REI.UN and HR.UN.

Disclaimer: This post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.

0 komentar:

Posting Komentar